CME Eyes Sports Contracts, FanDuel Role Unclear for Now

The Chicago Mercantile Exchange (CME) owner, CME Group (NASDAQ: CME), is apparently planning to sell sports event contracts by the end of this year, increasing the exchange operator's competitiveness with rivals in prediction markets, Kalshi and Polymarket.

Bloomberg broke the story earlier today, citing unnamed persons with knowledge of the situation. It's possible that futures commission merchants (FCMs) and other associated platforms will make the CME sports contracts accessible, which might allow retail brokers to sell the derivatives to customers. However, according to sources who spoke to Bloomberg, the situation is dynamic and subject to change.

Ten days after rival Intercontinental Exchange (NYSE: ICE), which operates the New York Stock Exchange (NYSE), acquired a $2 billion investment in Polymarket, one of the biggest prediction market operators, news of CME's possible sports derivatives venture surfaced. Polymarket is worth between $9 billion and $10 billion after the investment.

The report also appeared at a period of consistent news flow, indicating that Kalshi, Polymarket, and other prediction markets have seen a surge in volume due to football season. Sports betting stocks have suffered as a result of such headlines, but other analysts contend that the scenario is overblown and that traditional sportsbooks still command a far higher handle than prediction markets.

Is FanDuel Compliant With CME Sports Plans?

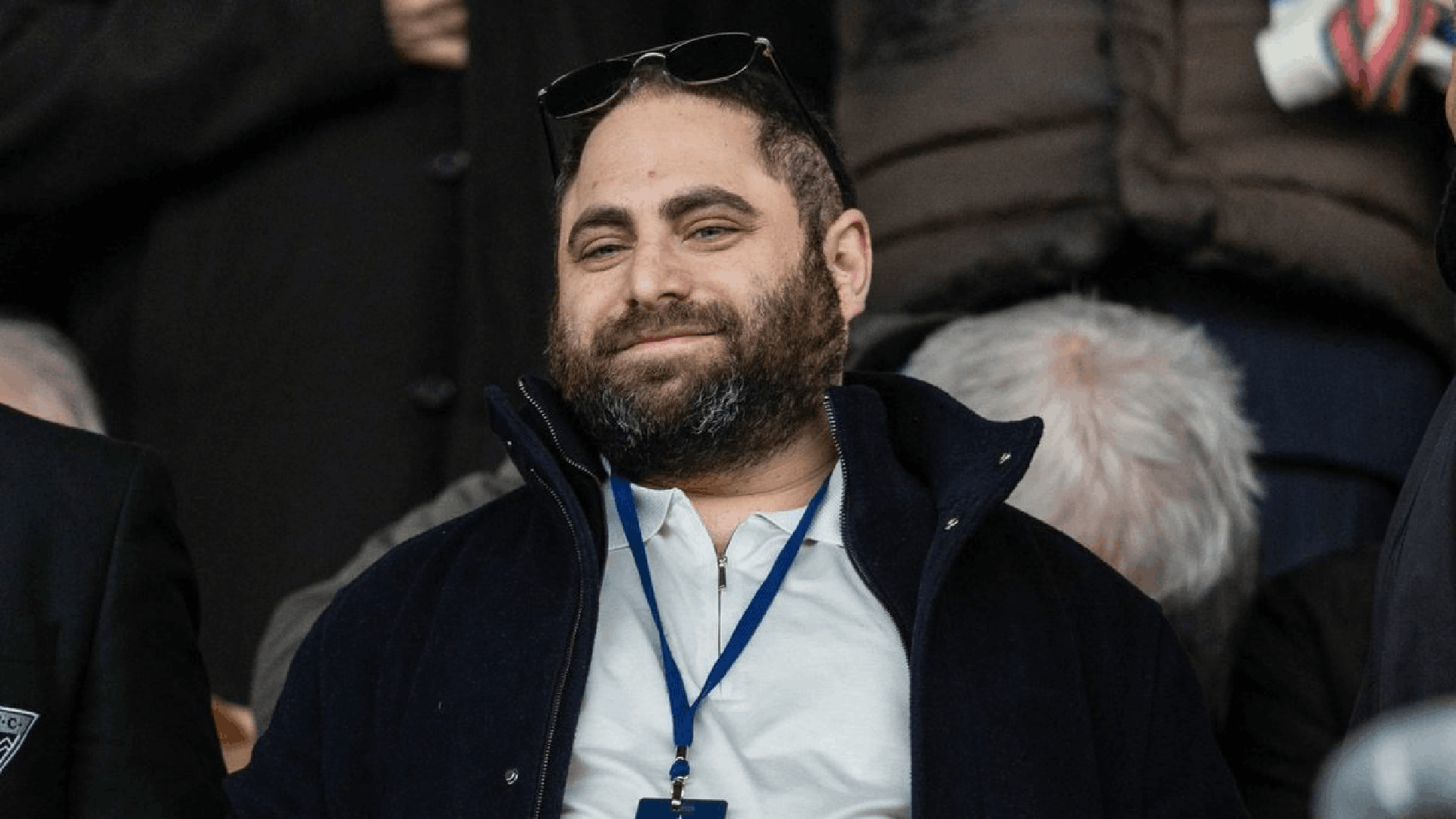

CME and FanDuel, which is owned by Flutter Entertainment (NYSE: FLUT), established a relationship in August that will allow them to provide sportsbook clients event contracts linked to financial asset prices and economic data releases.

It's unclear whether the biggest online sportsbook will be involved in the exchange operator's sports plans, but the aforementioned FCM structure CME is allegedly pursuing for sports contracts is similar to its partnership with FanDuel.

The companies announced in August that they would provide yes/no contracts on the daily performance of commodities, cryptocurrencies, key equity indexes like the Nasdaq-100 and S&P 500, and economic data updates like GDP and inflation. The derivatives can be purchased for as little as $1. In the future, more contracts might be provided.

“As we work with CME Group to develop our offering, we are continuing to prioritize active conversations with a variety of stakeholders including state regulators and have made no decisions as we maintain an open dialogue in an evolving legal and regulatory landscape,” a FanDuel representative told Bloomberg.

FanDuel Must Use Caution

It's unclear how much, if at all, FanDuel is involved in CME's potential sports contract offer. It is evident that the gaming corporation must exercise caution, if not completely avoid, any involvement in contracts related to sporting events.

Numerous states have cautioned sportsbook operators that entering into contracts for sporting events could put their licenses in danger. The risk of losing traditional gaming licenses may be too great for operators to enter prediction markets seriously at a time when the volume of prediction markets is minuscule in comparison to sportsbook handle.