Atlantic City Casino Profits Fall Nine Percent in 2024, But All Nine Resorts Profitable

All nine Atlantic City casino resorts stayed profitable in 2024, although their revenue and margins decreased.

On Monday, the New Jersey Division of Gaming Enforcement announced the fourth quarter and full-year results for 2024 concerning the nine casinos along the shore.

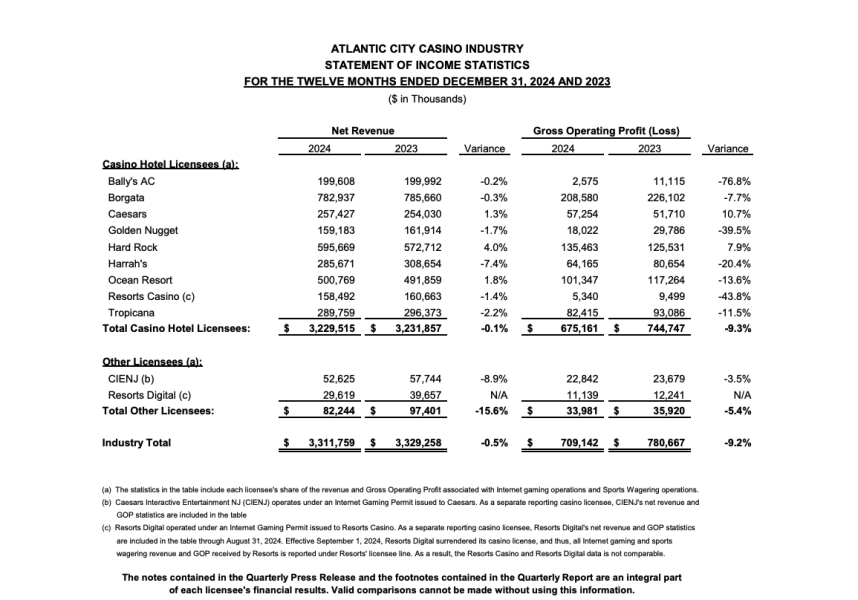

The filing revealed that net revenue decreased 0.5% from 2023 to just over $3.31 billion. Net revenue encompasses earnings from physical casino gaming and iGaming, retail and mobile sports wagering, food and drink, as well as hotel sales.

Although net revenue for the nine resorts decreased by less than 1%, their total gross operating profits fell by more than 9% to $709.1 million, a reduction of about $71.5 million. Gross profits, according to the DGE, represent revenues prior to interest, taxes, depreciation, amortization, affiliate costs, and various other factors.

Concerning Data

The 2024 Atlantic City casino earnings report shows that just two of the nine resorts were more lucrative last year compared to 2023. The properties that defied the trend were Caesars (increased 11% y/y) and Hard Rock (increased 8% y/y).

The other seven casinos saw decreased profits, with declines varying from 77% at Bally’s to 8% at Borgata. Borgata continued to be the highest-earning casino in Atlantic City with $208.6 million.

Ongoing inflation and economic conditions were cited as reasons for higher costs potentially reducing consumer spending.

“Increases in expenses and drags on consumer demand (initially observed in the third quarter and following through into the fourth) likely resulted in the disproportionate decline of 9.2% in year-over-year gross operating profit,” Jane Bokunewicz, director of Stockton University’s Lloyd D. Levenson Institute of Gaming, Hospitality, and Tourism, told the Press of Atlantic City.

Bokunewicz noted that during a time of “stabilizing physical” casino expansion, “rising costs” are anticipated as casinos boost investments in promotions to preserve customer loyalty.

Casino.org has recently received feedback from numerous guests who assert that a majority of their comps and incentives have vanished over the past few years. Stricter odds and increased table minimums are also cited as reasons for the uninspired play at the brick-and-mortar casinos.

In 2024, revenue from slot machines and table games at in-person casinos decreased 1.1% to $2.81 billion.

The nine casinos in Atlantic City experienced lower occupancy rates for their rooms last year as well. The 15,424 hotel rooms in the casinos were filled 72% of the time, a decrease of 1% from 2024.

The typical nightly rate for a casino room decreased from $181 in 2023 to $178 the previous year.

Optimistic Perspective

Mark Giannantonio, president of Resorts and the Casino Association of New Jersey, is optimistic that brighter days are coming for Atlantic City. He claims that the entertainment schedule for the summer of 2025 is more robust and busier compared to last year, and the recent renovation of the beach in the northern section of the Boardwalk will draw more vacationers in the warmer months.

"We have some of the best entertainment on the East Coast,” Giannantonio told Casino.org. Predicting a ''renaissance'', Giannantonio is forecasting that the 2025 summer will begin a new era and heyday for Atlantic City.

“For anyone who hasn’t been to Atlantic City recently, we provide value. You can see incredible shows and eat at world-class restaurants… we’re a market that’s on the rise,” Giannantonio said.